UDR (UDR)·Q4 2025 Earnings Summary

UDR Delivers Steady Q4 as Supply Pressures Ease, Guides Modestly Lower for 2026

February 9, 2026 · by Fintool AI Agent

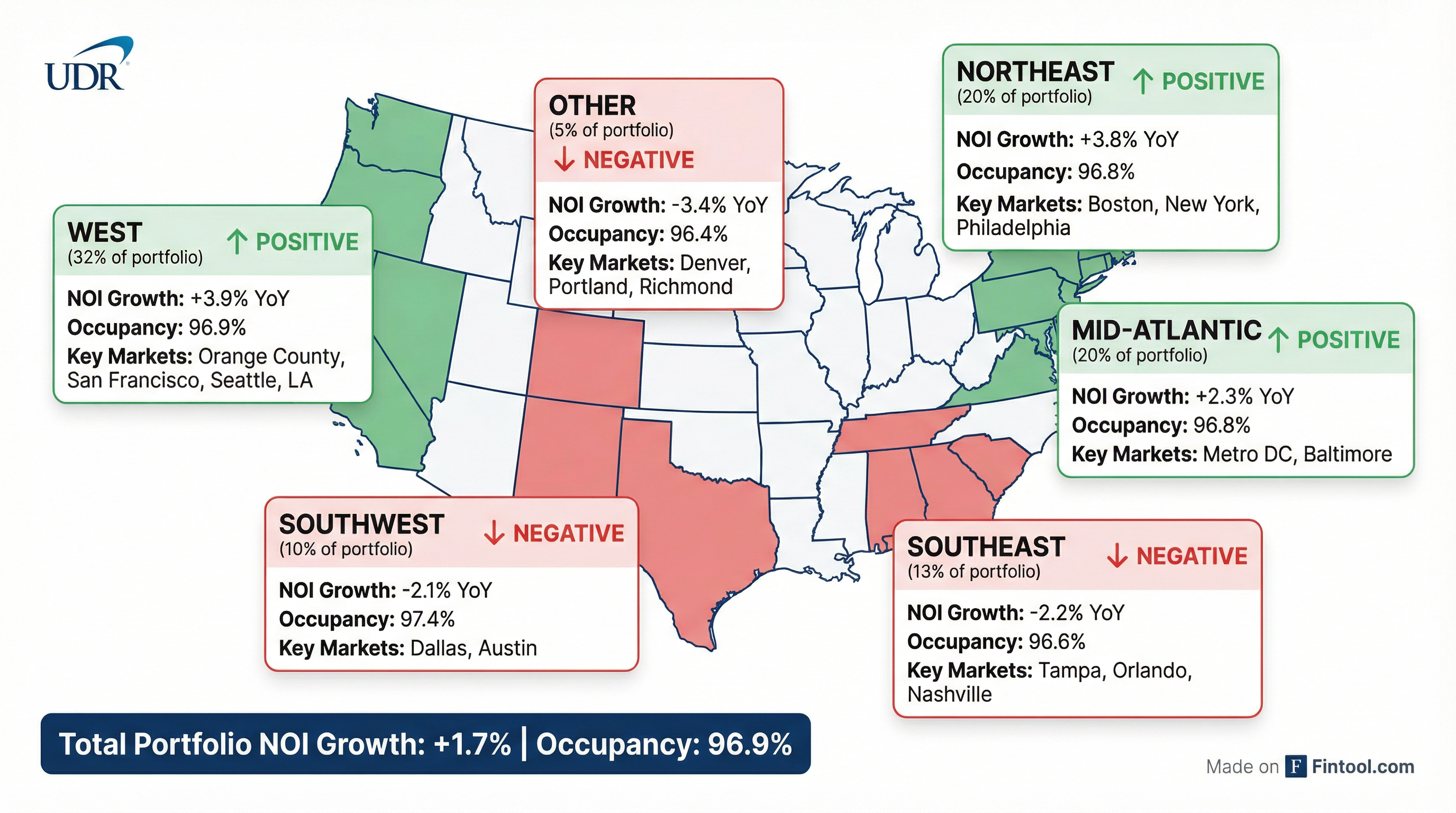

UDR, Inc. (NYSE: UDR) reported Q4 2025 results that landed squarely within expectations, with FFOA of $0.64/share matching the midpoint of guidance. The multifamily REIT posted same-store NOI growth of 1.7% YoY despite continued softness in Sunbelt markets. Looking ahead, management guided 2026 FFOA to $2.47-$2.57, implying essentially flat growth as expense pressures offset improving fundamentals.

The stock rose modestly (+0.4%) to $37.75 on the release—a muted reaction reflecting results that neither surprised to the upside nor disappointed.

Did UDR Beat Earnings?

In-line. UDR met guidance but didn't exceed it on key metrics.

The outsized net income beat ($0.67 vs. $0.13-$0.15 guided) was driven by a $195M gain from the LaSalle joint venture expansion—a one-time item excluded from FFO.

Full Year 2025:

- FFOA: $2.54 (top of $2.53-$2.55 guidance range)

- Same-Store Revenue: +2.4%

- Same-Store NOI: +2.3%

What Did Management Guide for 2026?

Management's 2026 outlook calls for essentially flat earnings growth, with expense pressures weighing on same-store NOI despite easing supply.

Key guidance assumptions:

- Dispositions: $300-$600M (joint venture and consolidated)

- Acquisitions: $100-$200M

- CapEx: $220-$260M

- Interest expense: $185-$195M

CEO Tom Toomey struck an optimistic tone despite the cautious numbers: "We start 2026 in a position of relative strength with positive operating momentum, easing supply pressures, and relative affordability of apartments that remains attractive versus other forms of housing."

How Did the Stock React?

UDR shares edged up +0.4% to $37.75 on earnings day—a tepid reaction signaling the results were largely priced in. The stock remains 19% below its 52-week high of $46.47, reflecting broader REIT sector pressure from elevated interest rates.

Over the past year, UDR has consistently met or beat expectations without major upside surprises—a pattern of steady execution rather than momentum.

What Changed From Last Quarter?

Positive shifts:

- Blended lease rate growth reaccelerated in late Q4 and into early 2026

- Resident turnover remained historically low at 29% annualized (vs. 32% in Q4 2024)

- West and Northeast regions delivered strong NOI growth (+3.9% and +3.8% respectively)

Concerning shifts:

- Same-store expense guidance for 2026 (+3.0% to +4.5%) up from 2025's +2.6%

- Sunbelt markets (Southeast, Southwest) continued to drag with negative NOI growth

- New lease rate growth remained deeply negative at -7.2% blended

What's Driving Regional Divergence?

UDR's coastal markets outperformed while Sunbelt exposure weighed on results.

COO Mike Lacy noted: "When demand unexpectedly weakened late in the third quarter, we quickly pivoted to a high-occupancy strategy. These maneuvers positioned the portfolio for a reacceleration of blended lease rate growth in the final months of 2025."

San Francisco led with +7.8% NOI growth, while Austin (-3.2%) and Tampa (-3.9%) were the weakest performers.

Capital Allocation Highlights

Q4 2025 Activity:

Balance Sheet Position:

- Total debt: $5.8B at 3.4% weighted average rate

- Net Debt-to-EBITDAre: 5.5x (unchanged YoY)

- Liquidity: ~$905M available

- Only $357M debt maturing through 2026 (6.7% of total)

Dividend Update

UDR announced a 2026 annualized dividend of $1.74/share, a 1.2% increase from 2025's $1.72. This marks the company's 213th consecutive quarterly dividend.

At the current price of $37.75, the implied dividend yield is approximately 4.6%.

Q&A Highlights

Management will host the earnings call on February 10, 2026 at 12:00 PM ET. Key topics likely to be addressed:

- Expense outlook: Why is 2026 expense growth guided 100-200 bps higher than 2025?

- Sunbelt recovery timing: When does management expect Southeast/Southwest to stabilize?

- Capital deployment: Will share repurchases continue at current levels?

- Supply dynamics: How quickly is new deliveries moderating in key markets?

Forward Catalysts

The Bottom Line

UDR delivered a clean quarter with no surprises—exactly what the market expected. The story for 2026 is cautious optimism: supply pressures are easing, coastal markets are performing well, but expense headwinds and Sunbelt softness will likely cap upside. Management's flat FFOA guidance reflects disciplined expectations rather than bullishness.

For income-focused investors, the 4.6% yield and consistent dividend growth remain attractive. For growth investors, the setup improves into 2027 as supply normalizes—but 2026 looks like a transition year.